Never trade on news. Everything is hidden in the price action !

(#Bitcoin ETF News)

In the world of trading, the pursuit of information is relentless, and market participants often look to significant events for signals to guide their investment decisions. In this particular instance, the community’s attention was fixated on the eagerly anticipated confirmation of Exchange-Traded Funds (ETFs) for Bitcoin, which was expected to provide a bullish catalyst for the market. However, despite the optimism surrounding this development, the market took an unexpected turn, plunging into the red.

The surprising twist came with the news that the US Securities and Exchange Commission (SEC) had granted approval for spot Bitcoin ETFs, as reported by Reuters (RTRS). Typically, such regulatory green lights are perceived as positive signals that attract investors eager to capitalize on the potential market upswing. Yet, contrary to expectations, the market moved in the opposite direction, catching many traders off guard.

This scenario serves as a stark reminder of the inherent unpredictability of financial markets and the cautionary principle of not relying solely on fundamental news when making trading decisions. The notion of “never trade with fundamental news” emphasizes the importance of considering various factors and not placing undue reliance on single events, as market dynamics are influenced by a multitude of variables.

In the aftermath of the unexpected market movement, traders and analysts reflect on the significance of price action – the ultimate arbiter of market sentiment. Price action, as revealed by the movement of asset prices on charts, encapsulates all relevant information, including market sentiment, investor behavior, and macroeconomic factors. The assertion that “everything is hidden in the price action” underscores the belief that, ultimately, the market’s response to news and events is encapsulated in the way prices move.

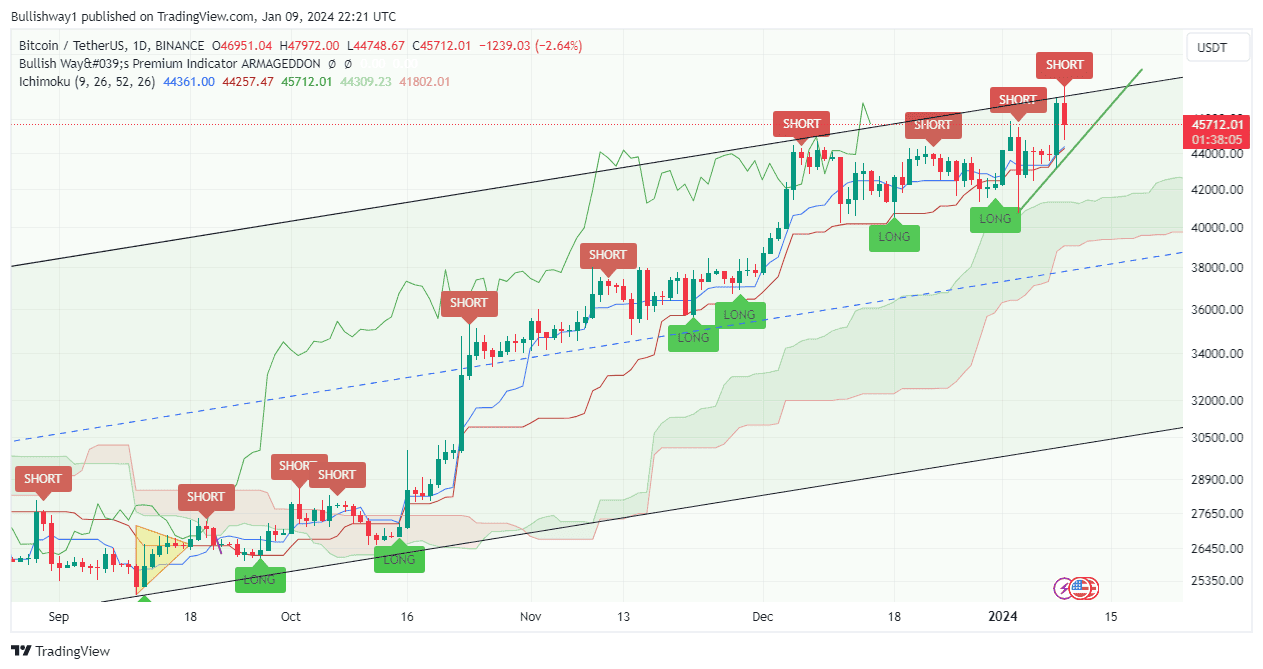

Examining the specific case of Bitcoin, traders observed that the cryptocurrency had reached the upper boundary of a trading channel, coinciding with a short signal generated by a key indicator. In a departure from the prevailing sentiment and conventional wisdom, some traders decided to open short positions, betting on a market downturn. The decision to go against the prevailing narrative and take a contrarian stance demonstrates the nuanced nature of trading, where a comprehensive analysis of both technical indicators and price action is crucial.

In the end, the trading strategy of opening short positions amid a seemingly bullish backdrop proved to be profitable for those who accurately interpreted the signals from the price action and indicators. This episode reinforces the importance of a well-rounded approach to trading that incorporates both fundamental and technical analyses, while always acknowledging the unpredictable nature of financial markets.

As traders navigated the aftermath of the unexpected market movement following the SEC’s approval of spot Bitcoin ETFs, the incident highlighted the intricate dance between market sentiment and the underlying forces that shape asset prices. The initial anticipation of positive momentum triggered by regulatory approval was replaced by a swift market downturn, prompting a collective reevaluation of strategies.

The adage “never trade with fundamental news” is a cautionary reminder that, while significant events can provide valuable insights, they do not guarantee a one-to-one correlation with market movements. Traders must recognize the complexity of market dynamics and the multitude of factors that contribute to price shifts. While fundamental news can be a crucial piece of the puzzle, relying solely on it can be precarious, as demonstrated by the unexpected turn of events.

The emphasis on price action as the ultimate arbiter of market conditions underscores the belief that, in the end, the collective decisions and sentiments of market participants are reflected in the movement of asset prices. Technical analysts often argue that charts, patterns, and indicators provide a more holistic view of market behavior, capturing the essence of investor psychology and sentiment.

Zooming in on the specific case of Bitcoin, the observation that the cryptocurrency had reached the upper limit of a trading channel, coupled with a short signal from Bullish Way’s premium indicator “Armageddon2” , added a layer of complexity to the decision-making process. Traders who integrated technical analysis into their strategy recognized the confluence of signals pointing towards a potential downturn. This multidimensional approach allowed them to sidestep the prevailing bullish sentiment and make decisions grounded in a more comprehensive analysis.

The decision to open short positions in the face of bullish expectations speaks to the contrarian nature of trading. Successful traders often distinguish themselves by their ability to go against the prevailing narrative, leveraging a nuanced understanding of market indicators and dynamics. The ability to discern when the market might defy expectations and take a position contrary to the consensus is a skill honed through experience and a deep understanding of market behavior.

Ultimately, the traders who navigated the complexities of this particular market scenario by combining fundamental awareness with technical insights were able to capitalize on the divergence between expectation and reality. This event serves as a reminder that a well-rounded trading strategy should encompass a broad spectrum of analyses, acknowledging the uncertainty inherent in financial markets. Balancing fundamental news with technical indicators allows traders to develop a more resilient approach, adapting to the ever-changing landscape of market conditions.